Your score falls within the range of scores, from 580 to 669, considered Fair. A 583 FICO® Score is below the average credit score.

Some lenders see consumers with scores in the Fair range as having unfavorable credit, and may decline their credit applications. Other lenders that specialize in "subprime" lending, are happy to work with consumers whose scores fall in the Fair range, but they charge relatively high interest rates and fees.

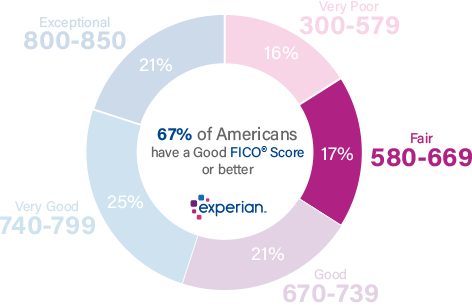

17% of all consumers have FICO® Scores in the Fair range (580-669)

.

Approximately 27% of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future.

How to improve your 583 Credit Score

Think of your FICO® Score of 583 as a springboard to higher scores. Raising your credit score is a gradual process, but it's one you can begin right away.

83% of U.S. consumers' FICO® Scores are higher than 583.

You share a 583 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your credit reports and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Moving past a Fair credit score

While everyone with a FICO® Score of 583 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 39% of Americans with a FICO® Score of 583 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments (30 days or more past due) and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptcies—events that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

The basis for your credit score

Credit scores such as the FICO® Score are based on your debt-management history, as recorded in your credit file. The scores are basically a summation of the way you've handled credit and bill payment. Good credit habits tend to promote higher credit scores, while poor or erratic habits tend to bring lower scores.

Here's a more detailed breakdown of the specific factors that influence your FICO® Score:

Public Information: If bankruptcies or other public records appear on your credit report, they can have severe negative impacts on your credit score.

Among consumers with a FICO® Score of 583, the average credit card debt is $5,908.

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. It's pretty straightforward, and it's the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

Credit usage rate. To determine your credit utilization ratio, add up the balances on your revolving credit accounts (such as credit cards) and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you "max out" your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Length of credit history. Credit scores generally benefit from longer credit histories. There's not much new credit users can do about that, except avoid bad habits and work to establish a track record of timely payments and good credit decisions. Length of credit history can constitute up to 15% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans (i.e., loans with fixed payments and a set repayment schedule, such as mortgages and car loans) and revolving credit (i.e., accounts such as credit cards that let you borrow within a specific credit limit and repay using variable payments). Credit mix can influence up to 10% of your FICO® Score.

Recent applications. When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well). A hard inquiry typically has a short-term negative effect on your credit score. As long as you continue to make timely payments, your credit score typically rebounds quickly from the effects of hard inquiries. (Checking your own credit is a soft inquiry and does not impact your credit score.) Recent credit applications can account for up to 10% of your FICO® Score.

Improving Your Credit Score

Fair credit scores can't be made into exceptional ones overnight, and bankruptcies, foreclosures and some other negative issues that contribute to Fair credit scores only resolve themselves with the passage of time. But no matter the cause of your Fair score, you can start handling credit more, which can lead in turn to credit-score improvements.

Seek a secured credit card. A secured card can benefit your credit score, even if you don't qualify for traditional credit cards. Once you've confirmed that the lender reports card activity to the national credit bureaus, you put down a deposit in the full amount of your spending limit—typically a few hundred dollars. When you use the card and make regular payments, those activities will be recorded in your credit files. And as long as you keep your usage rate on the card below about 30%, and stay on schedule with your monthly payments, they'll help you build stronger credit.

Consider a credit-builder loan. As the name implies, these are specialty loans designed to help build or shore up borrowers' credit profiles, by demonstrating the ability to make regular monthly payments. When you take out one of these loans, the credit union places the money you've borrowed in a savings account that generates interest. Once you've paid off the loan, you get the cash and the interest it has accrued. It's a neat savings tool, but the real payoff comes as the credit union reports your payments to the national credit bureaus, which can lead to credit-score improvements. (Double-check with the lender to make sure they report activity to all three national credit bureaus before you apply for a credit-builder loan.)

Consider a debt-management plan. A debt-management plan (DMP) can be helpful to borrowers who find themselves overextended and unable to keep up with credit payments. Working in conjunction with an authorized credit-counseling agency, you negotiate a manageable repayment schedule, effectively closing all your credit accounts in the process. This is a major step that can seriously harm your credit score in the near-term, but it's less damaging than bankruptcy and can eventually give you a clean start on rebuilding your credit. Even if a DMP isn't for you, a good non-profit credit counselor (as distinct from credit-repair company) can help you find strategies for building up your credit.

Pay your bills on time. If you could do only one thing to improve your credit score, nothing would help more than bringing overdue accounts up to date, and avoiding late payments as you move forward. Do whatever you can to remind yourself to pay the bills on time: Use automatic payments, set calendar alarms, or just write yourself notes and pin them where's you'll see them. Within a few months you'll train yourself in habits that promote higher credit-scores.

Avoid high credit utilization rates. Credit utilization, or debt usage, is the basis for about 30% of your FICO® Score. Keep your utilization rate below about 30% can help you avoid lowering your score.

Among consumers with FICO® credit scores of 583, the average utilization rate is 78.2%.

Try to establish a solid credit mix. You shouldn't take on debt you don't need, but prudent borrowing, including a combination of revolving credit and installment debt, can be beneficial to your credit score.

Learn more about your credit score

A 583 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and reduced fees. You can begin by getting your free credit report from Experian and checking your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.